Shopify's Gross Merchandise Volume Growth

Disclaimer - This is not intended to be investment advice or even a discussion on the stock, its valuation and expected performance. For full disclosure, I do not currently have any direct position in SHOP but do own a small amount as part of broad market and tech ETFs.

Shopify has redefined e-commerce for businesses and individual around the globe, and its Q3 2024 results prove the company’s relentless momentum. Last week, Shopify announced its financial results for the third quarter, which ended September 30th, 2024, with $2.162 billion in revenue, $1.118 billion in gross profit, and $421 million in free cash flow (FCF).

No more doubts remain about the size of Shopify. Since its IPO in 2015, the company has now grown to be the largest Canadian publicly traded technology company, and the second largest overall, behind only the Royal Bank of Canada (RBC). It currently has a valuation of approximately 186.6B CAD.

How Does Shopify Make Money?

Simply put - Shopify is a commerce platform for businesses and individuals to sell products and services. Their revenue is split into two categories: Subscription Solutions and Merchant Solutions.

Subscription Solutions consists of access to the Shopify Platform which allows businesses to create online stores and sell their products. It also includes adjacent products such as themes, apps, domain names, etc. Shopify customers can also subscribe to direct Point-Of-Sale (POS) services. Within these, there’s much variety depending on the size of businesses and what their domain is. For example, there’s different tiers to the Shopify platform itself, scaling up to the Shopify Plus all-in-one platform. Most of these services have a monthly payment but some can be paid upfront for a year.

Shopify’s Merchant Solutions aim to provide additional capital and technology support to the businesses themselves. Amongst the many listed, there are:

- Shopify Payments - a payment processing service to process cards online and offline.

- Shopify Capital - money lending solutions to secure financing and grow businesses.

- Shopify Shipping - manage fulfillment and shipping with partners, print labels, track orders, etc.

- Shop Pay Installments - “Buy now and pay later” services

- POS Hardware for brick-and-mortar shops.

These services, and more, show just how much the company has grown into new adjacent fields. Since many of these services are only available in a few countries, there are opportunities for expansion. Another recent example that was mentioned on the latest earnings call was Managed Markets which helps companies expand cross-border.

Who Uses Shopify?

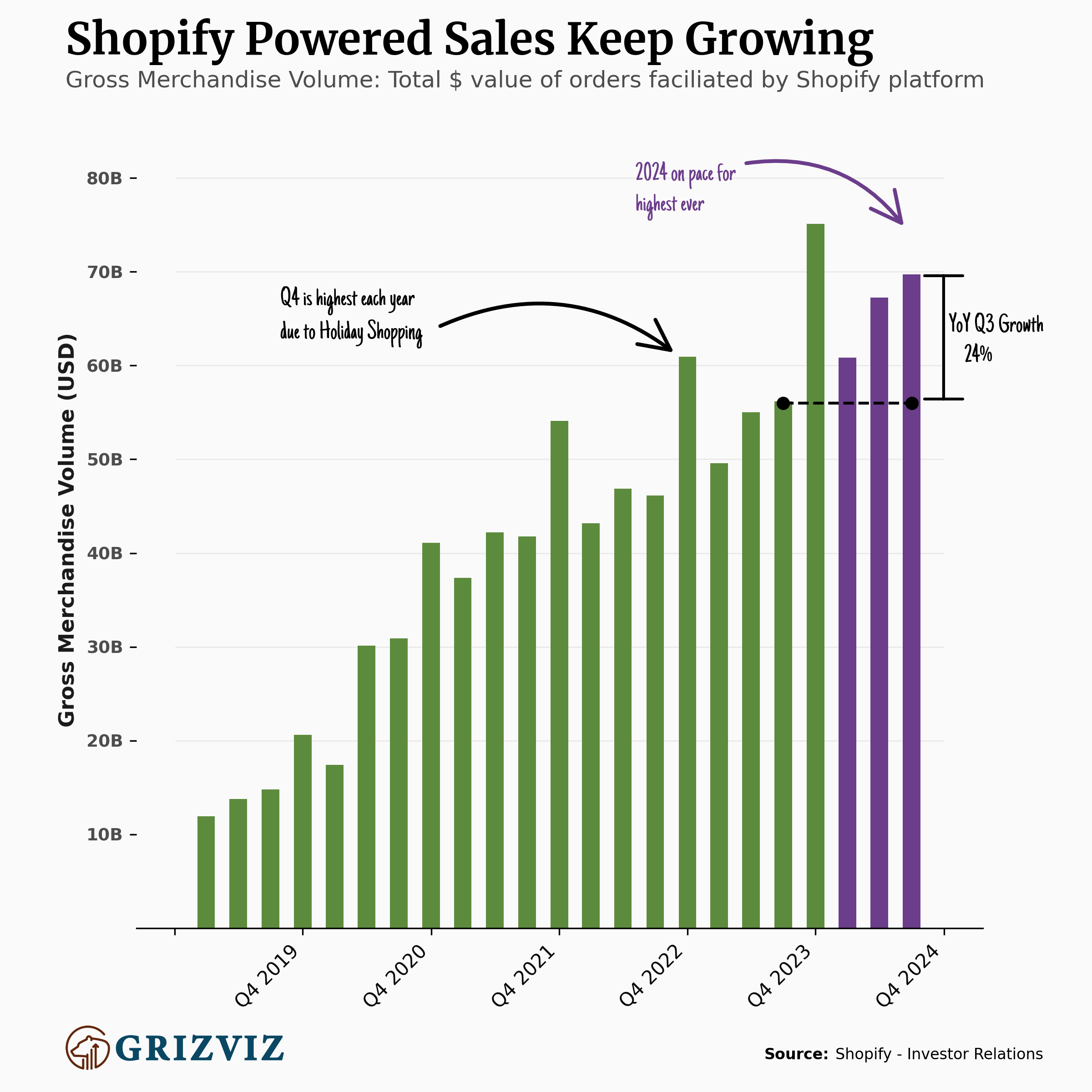

Given that this last quarter (Q3 2024) nearly 70 Billion USD was processed through Shopify, it’s easy to see that a huge number of companies use the services of this Canadian behemoth. In last year’s annual report, some of the mentioned companies that use Shopify Plus, are GymShark - the large British apparel company, Heinz, Kylie Cosmetics and SKIMS - by Kylie Jenner and Kim Kardashian, and Supreme. Other companies listed on the Shopify website for a variety of services include Staples, Sony, Converse and SRTX- Canada’s fast growing tights and textile material science company.

In the earnings call, Shopify directly mentioned WatchesOfSwitzerland, the Body Shop and Reebok as having signed on with the platform this last quarter.

What is GMV and Why is it Important?

The plot above shows the growth in GMV. GMV stands for Gross Merchandise Volume. It is an important metric Shopify has defined and tracked at least since its public offering in 2015. It represents the total dollar value of orders facilitated through the company’s platform: companies use Shopify to sell products. GMV proves that they are able to do so. This metric is really important for Shopify since it states that “The majority of our merchant solutions revenue is directly correlated with the level of GMV that our merchants process through our platform”. Essentially, subscription services are generally closer to fixed costs (they can vary with scaling in use) while for many merchant services, a percentage of sales or payments processed (GMV) is earned by Shopify.

With its growing suite of tools and international expansion opportunities, Shopify is positioned to continue leading the commerce platform space. The question remains—how far can it go?